What is a Notary Signing Agent in Raleigh NC

A Loan Signing Agent is a specially trained Notary to handle and notarize loan documents. Notary signing agents in Raleigh are a critical final link to completing the loan and ensuring that real estate loan documents are executed by the borrower, notarized, and returned for processing on time. Completing this critical part of the loan process enables the loan to be funded.

How to Select a Raleigh Signing Agent

When considering choosing a notary for your loan documents, it is best to select an NNA Certified Signing Agent or a notary that understands the procedures to make an outstanding loan signing experience. Loan documents are sensitive and demand extra attention to detail when completing. If you have a notary that is not familiar with the process, you could be facing funding delays, fees, late closing dates, or multiple signing attempts. The banks and loan processors comb through all of the documents meticulously to know they precisely have what they need. A notary signing agent is experienced and knowledgeable and is prepared to meet the closing conditions of the loan concerning signing docs. Raleigh Mobile Notary provides professional services for your loan signing in Raleigh, and that comes with a reputation for delivering excellence every time!

Signing Agent Roles

A Raleigh Notary Signing Agent will verify that you are who you say before signing any documents. To do this, they require that you provide identification, which is typically a photo ID such as a driver’s license or state ID. See below for a list of accepted types of identification.

The Notary Signing Agent will ensure that you sign and date all the required documents that require it at closing. They will ensure, along with your signatures, that any co-signers sign and date in the correct places on the forms as well. After signing, they will themselves sign and stamp the appropriate documents with their notary seal or stamp to verify that they witnessed you sign the documents. A notary signing, stamping (sealing), and adding their commission information is called “notarization.”

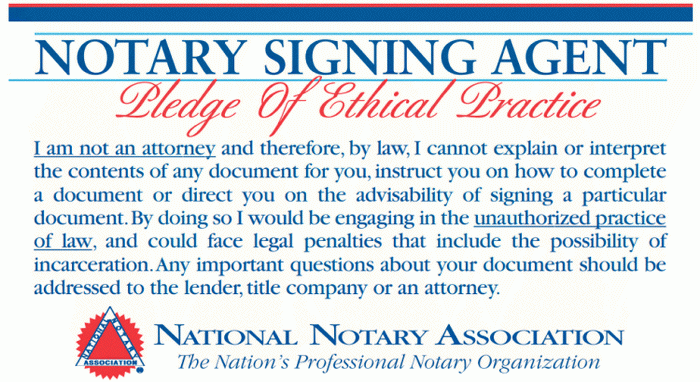

A Notary Signing Agent is prohibited from preparing documents or answering specific questions about the loan by the governing laws. If you have questions about the documents during the signing, the Raleigh notary must refer you to the closing agent or the lender. A Signing Agent's duty is to assure each signer is physically present, identified appropriately, all documents are signed and initialed, and that each signature requiring notarization is appropriately notarized.

Notary Contact Form

Tap to Call

Raleigh Signing Agent for Home Equity Line of Credit (HELOC)

A home equity line of credit or often called HELOC for short is a line of credit for your home. It's more commonly known as a 2nd loan. The documents transactions for HELOC transactions are different from traditional home loans. There is no promissory note with an interest rate, but there is a credit agreement with Annual Percentage Rates (APR) and special terms that come with it. As 2nd loans are a little less common these days, it is best to find a notary signing agent prepared and understand the processing of these documents.

Second loans are typically tied together with the first loan when making a home purchase. It is vitally important that both the 1st and 2nd loans are signed without error as they're processing may affect the home purchase. Raleigh Mobile Notary has provided successful notary services in Raleigh for home equity lines of credit for several banks such as Wells Fargo, Bank of America, and other large banking institutions. Your loan officer should be able to answer any specific questions about your HELOC loan, but if you have questions about a notary for HELOC loans, we can help you there!

Raleigh Signing Agent for Home Refinances

It's refinancing time, and you may be refinancing for a better interest rate, to change the terms of your loan, or to move your equity around. Your bank, mortgage company, and loan officer have gone through all of the information within your life. You did it! The documents are in, and it's time to sign.

If this is your principal residence, federal law typically gives you three business days to review your documents. There is good news, if this your first time and you're a little nervous about it, no worries because you'll have some time to review the paperwork even after signing. If you've signed loan docs before, you're already pro, as you've seen the big stack of disclosures the bank sends to you, and you're ready to thumb through it and sign, and we're glad to be helpful either way. We provide our clients time that they may need to feel comfortable with the documents they're signing. On the flip side, If signers are ready to go, we're prepared to streamline the process.

Refinance documents come with their own set of instructions, which demands special care. These guidelines may include "sign exactly as your name appears on the line" or "all documents must be signed in blue ink." These are essential guidelines that all notary signing agents should know. County Recorders will often reject incomplete signatures. The black ink used for signatures is often mistaken for photocopies, and originals get sent to the wrong agencies. You can see how these guidelines become important when there are essential deadlines to meet, especially if you've locked in at a great mortgage rate. Raleigh Mobile Notary is equipped and prepared to help with refinances for you, your mortgage company, or your bank.

Raleigh Signing Agent for Home Purchases

We don't need to tell you that a lot is going on when you are purchasing a home! You've already collected hundreds of real estate contracts. Give us a call when you receive the loan documents. We have many successful transactions behind us. We streamline the signing process and make it easy as possible and comfortable for you when you're signing. We triple check for signatures, which has earned us high approval ratings from escrows and mortgage companies and clients themselves. You'll have a good night's sleep after signing docs with your Raleigh Mobile Notary signing agent, and we'll even meet you at a place and time that is convenient for you.

Raleigh Signing Agent for Reverse Mortgages

Reverse mortgages have served as a way for families, especially the elderly, to utilize their homes' equity. In reverse mortgages, the bank will use their home equity to make regular payments to individuals to supplement their income.

The reverse mortgage docs may resemble loan documents as they come with many of the same loan disclosures, but they are very different. Lenders will play a different role in a reverse mortgage, and there is documentation to meet that need for reverse mortgages, as reverse mortgages also tend to attract the elderly who may have questions. It is best to have a sensitive and understanding notary while appropriately directing questions to the appropriate loan officer.

© 2022 Raleigh Mobile Notary. All Rights Reserved.